A Market No Longer Driven by Scent Alone

Fragrance used to be a slow, heritage-driven category. Distribution was physical, differentiation was narrative, and innovation cycles were measured in years.

That model is breaking.

Today’s fragrance market is being reshaped by three structural forces: personalization at scale, identity signaling over mass appeal, and systemic expansion driven by premiumization and e-commerce. Fragrance is no longer just about what smells good—it’s about how scent is produced, personalized, distributed, and re-purchased.

Below are the eight fragrance trends Superway is actively tracking.

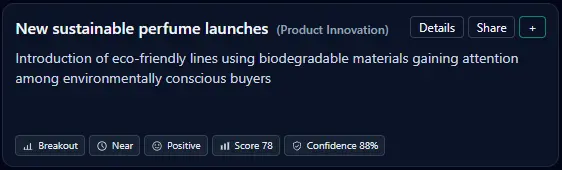

1. New Sustainable Perfume Launches

Eco-positioned fragrance launches are accelerating across the US market. Brands are introducing biodegradable ingredients, refillable bottles, recycled packaging, and carbon-neutral sourcing as baseline expectations rather than differentiators. Clean-leaning fragrance brands such as Phlur and Heretic Parfums have helped normalize sustainability-first positioning, while heritage players like Le Labo have expanded refill programs and ingredient transparency.

What’s actually changing is not branding—it’s infrastructure. Sustainability now constrains supply chains. Ingredient sourcing, packaging vendors, and regulatory readiness increasingly determine which brands can scale without friction.

This shift is happening now because clean beauty norms established in skincare are fully crossing into fragrance. Retailers are raising ESG standards, and younger consumers increasingly view unsustainable luxury as internally inconsistent.

Second-order effects include higher fixed costs that favor well-capitalized independents, refill systems that increase lifetime value, and reduced formulation flexibility as ingredient disclosure becomes unavoidable.

Builder playbook: design refill systems early, secure sustainable raw-material contracts long-term, and treat sustainability claims as auditable systems—not marketing copy.

2. AI-Customized Fragrance Options

AI-driven fragrance personalization is moving from experiment to product. Machine-learning systems are now being used to generate custom scent profiles based on user preferences, mood inputs, or biometric data. Large fragrance houses like Givaudan and dsm-firmenich are actively investing in AI-assisted scent creation, while projects like Philyra, developed with IBM, demonstrate how algorithmic perfumery can operate at scale.

What’s actually changing is where defensibility lives. The core IP shifts from secret formulas to data models, feedback loops, and recommendation accuracy. The brand that learns fastest wins.

This is happening now because consumers already expect personalization in fashion and skincare, ML tooling costs have dropped, and DTC channels finally allow brands to capture first-party preference data.

Second-order effects include smaller batch production, inventory risk reduction, and a structural shift in the perfumer’s role—from sole creator to system trainer.

Builder playbook: prioritize preference capture UX, constrain personalization before expanding it, and use AI to augment perfumers rather than replace them.

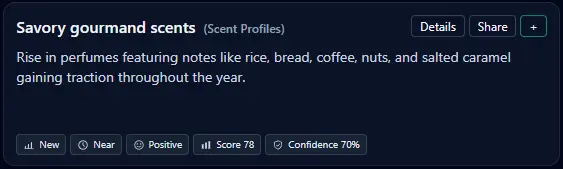

3. Savory Gourmand Scents

Savory gourmand fragrances represent a clear break from vanilla-heavy sweetness. Notes like coffee, roasted nuts, salt, truffle, and umami accords are gaining traction, particularly within niche fragrance communities. Experimental houses such as Zoologist Perfumes and boundary-pushing releases from brands like Le Labo reflect this broader move away from sugar saturation.

The underlying shift is consumer fatigue. Sweet gourmands have become predictable, opening space for bitterness, savoriness, and culinary realism. Platforms like Fragrantica show growing discussion around savory profiles as collectors search for novelty.

This trend is emerging now because food culture increasingly celebrates umami, and social platforms reward unexpected sensory narratives.

Second-order effects include higher memorability, greater polarization, and a heavier reliance on sampling to drive conversion.

Builder playbook: launch savory profiles as limited runs, anchor unusual notes with familiar structures, and build sampling funnels before scaling.

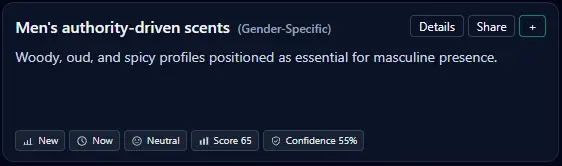

4. Men’s Authority-Driven Scents

Men’s fragrances emphasizing oud, leather, tobacco, and spice are regaining momentum, positioned explicitly around confidence and authority. Flagship products like Creed Aventus, Tom Ford Oud Wood, and Dior Sauvage continue to anchor this category.

What’s actually changing is usage intent. Fragrance is increasingly used as a behavioral signal—something worn to project presence in professional and social settings.

This trend is accelerating due to influencer-driven fragrance discourse on TikTok and Instagram, combined with renewed cultural negotiation around masculinity and identity.

Second-order effects include normalization of stronger projection, faster trend cycles around hero notes, and sharper gender segmentation after years of unisex positioning.

Builder playbook: message around context of use, balance power with wearability, and plan for faster product refresh cycles.

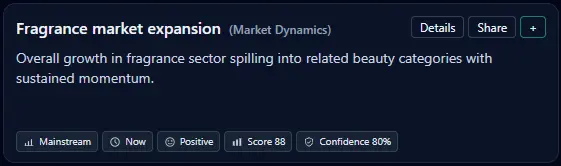

5. Fragrance Market Expansion

The US fragrance market continues to expand, driven by premiumization, e-commerce acceleration, and spillover from adjacent beauty categories. Luxury houses like Chanel and Dior continue to invest heavily in fragrance as a core growth lever rather than a secondary category.

What’s actually changing is category importance. Fragrance now functions as a high-margin, repeatable revenue engine within broader beauty portfolios.

This is happening because fragrance performs well in DTC environments, supports subscriptions and replenishment models, and remains resilient even during uneven consumer spending cycles.

Builder playbook: design for repeat purchase, invest early in logistics, and treat fragrance as a platform—not a one-off SKU.

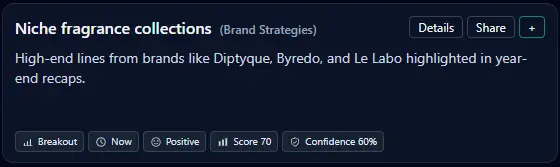

6. Niche Fragrance Collections

Niche fragrance brands emphasizing artisanal blends, rare ingredients, and limited editions continue to gain share. Brands such as Byredo, Diptyque, and Le Labo exemplify how cultural credibility can rival scale.

What’s actually changing is how value is perceived. Niche credibility itself functions as a status signal, amplified by social media and scarcity.

Second-order effects include tighter production discipline, increased reliance on brand mythology, and rapid erosion of differentiation once copycats emerge.

Builder playbook: protect brand narrative, use scarcity intentionally, and avoid premature mass expansion.

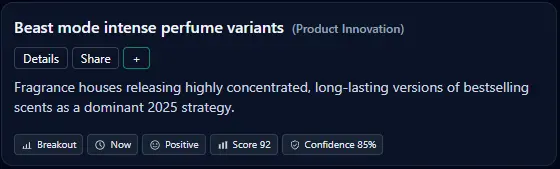

7. Beast Mode Intense Perfume Variants

Ultra-intense fragrances marketed around longevity and projection—often labeled “beast mode”—are surging in online communities. Products like Armaf Club de Nuit dominate discussion on platforms such as Fragrantica, Reddit, and TikTok.

What’s actually changing is that intensity itself has become a feature. Longevity and sillage are treated as performance metrics rather than secondary attributes.

Second-order effects include higher return risk if expectations are mismanaged and growing regulatory scrutiny around concentration levels.

Builder playbook: set clear usage expectations, educate consumers on application, and consider offering multiple intensity tiers.

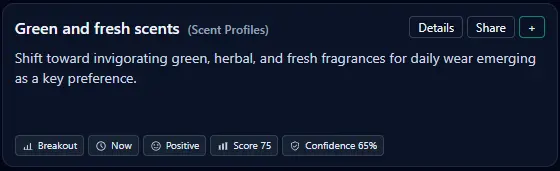

8. Green and Fresh Scents

Green, herbal, citrus, and aquatic fragrances are increasingly positioned as daily-wear staples aligned with wellness culture. Iconic fresh profiles like Giorgio Armani Acqua di Giò and lighter offerings from Creed continue to anchor this category.

What’s actually changing is usage frequency. Fresh scents are becoming everyday utilities rather than seasonal options, driving repeat behavior.

Second-order effects include shorter shelf life, stronger subscription economics, and increased pressure to differentiate beyond generic citrus.

Builder playbook: optimize for repurchase cadence, pair freshness with subtle signatures, and avoid interchangeable positioning.

Meta Synthesis: From Product to System

Across all eight trends, fragrance is evolving from a static luxury product into a dynamic system shaped by data, identity, supply chains, and repeat behavior.

The brands that win won’t just smell good. They’ll learn faster, retain longer, and adapt production in near real time.

Superway monitors real-time signals across products, platforms, and consumer behavior to identify trends as they form, not after they peak. The result is practical, decision-grade research designed for people building in the market—not reacting to it.