Holiday 2025 is rewriting the playbook for global e-commerce. Shifts in consumer behavior, payment innovation, mobile dominance, and AI-powered shopping tools are producing one of the most transformative seasons in recent years.

Superway analyzed millions of real-time signals—from search spikes to platform performance to device-level shopping patterns—to break down the most important trends shaping today’s digital marketplace. These insights reveal not only how consumers are buying now, but what will define the next generation of online retail.

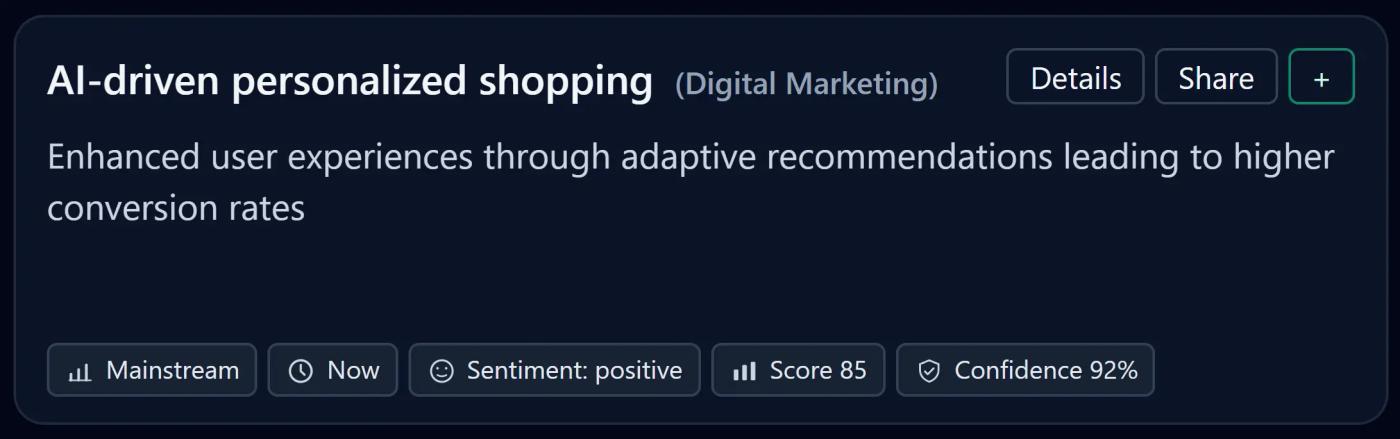

1. AI-Driven Personalized Shopping

AI-first retail is rapidly becoming mainstream. Adaptive recommendations, dynamic product sequencing, and real-time personalization are improving user experience and significantly increasing conversion rates. AI-driven personalization technology is transforming how consumers discover and purchase products.

Consumers now expect:

- Tailored product suggestions

- Predictive cart-building

- AI-powered discovery instead of manual browsing

- End-to-end personalization across channels

With a 92% confidence score and strong sentiment, AI-driven personalization technology is no longer a differentiator—it's the new standard for e-commerce UX.

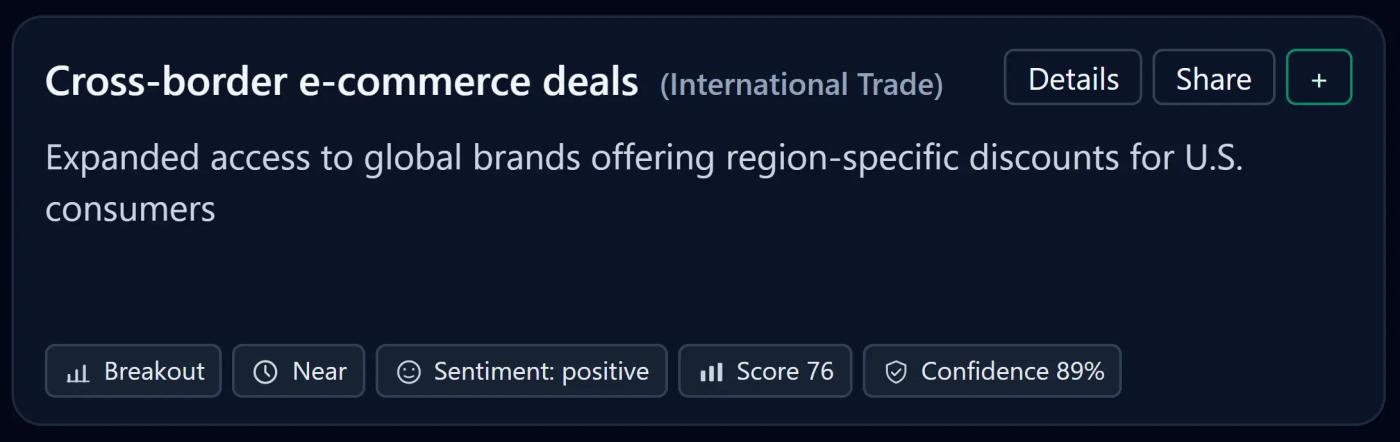

2. Cross-Border E-Commerce Deals

Holiday shoppers are looking beyond domestic retailers, driven by global discounting, currency advantages, influencer recommendations, and better cross-border logistics.

Key drivers include:

- Marketplaces offering region-specific pricing

- Faster and cheaper international shipping

- Expanded access to foreign brands

- Social commerce pushing global trends

This “borderless buying” behavior is surging, with a breakout momentum that signals sustained growth through 2026.

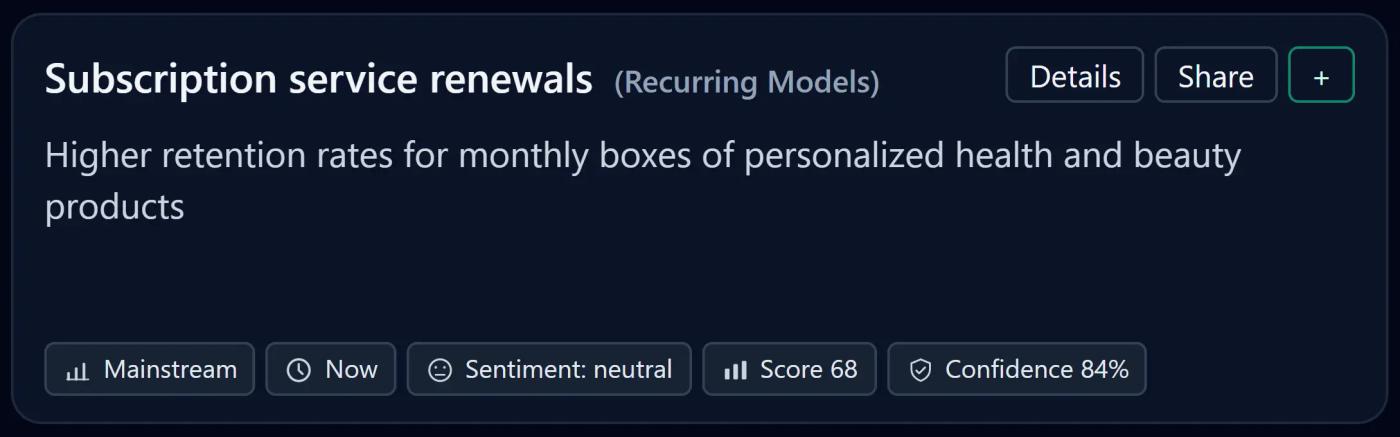

3. Subscription Service Renewals

Subscription models—especially in health, beauty, and wellness—are seeing renewed strength. Higher retention rates indicate that consumers favor predictable replenishment and personalized monthly boxes despite tighter budgets.

Major forces behind the growth:

- Auto-replenish convenience

- Exclusive subscriber-only perks

- Personalized product curation

- Increasing gifting of subscription services

Although sentiment is neutral, adoption is steady and resilient.

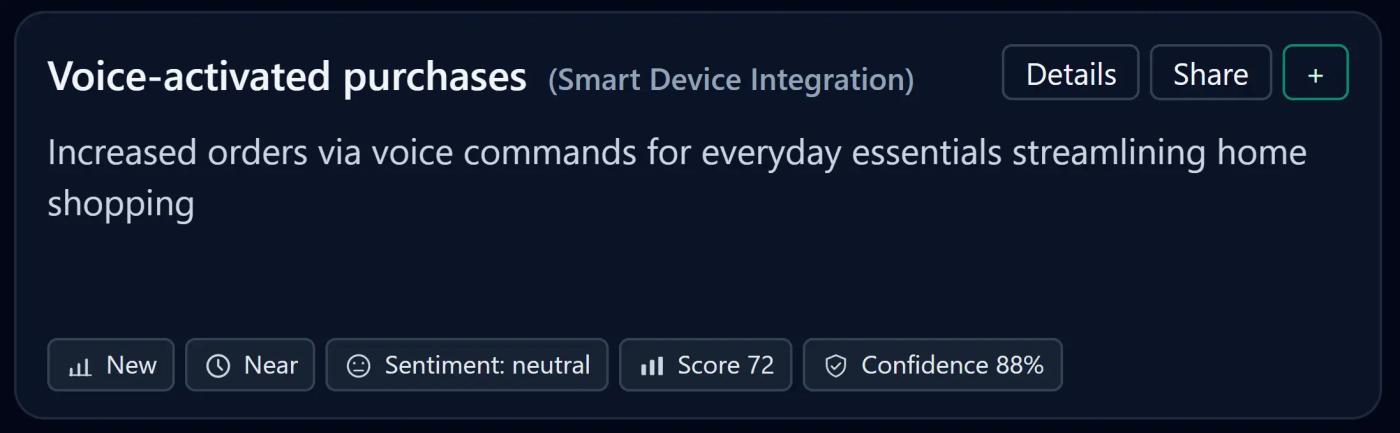

4. Voice-Activated Purchases

Voice commerce is gaining traction as smart devices integrate more naturally into daily routines. Consumers are placing quick, frictionless orders for essentials through voice commands.

Why it’s rising now:

- Increased accuracy of voice assistants

- Reordering convenience

- Growing adoption of smart home ecosystems

- Hands-free shopping in household and kitchen environments

With 88% confidence, voice-activated purchasing is on track to become a core micro-behavior in home shopping.

5. Augmented Reality Try-Ons

AR is transforming digital decision-making, especially in categories like fashion, beauty, eyewear, and home goods. This fashion retail innovation is helping customers make more confident purchase decisions.

AR try-ons are becoming mainstream due to:

- More accurate 3D modeling

- In-app AR in major marketplaces

- Higher conversion rates for AR-viewed products

- Reduced returns through improved fit visualization

Positive sentiment and strong adoption make AR a key differentiator for fashion retail innovation in 2026.

6. Record Black Friday Online Sales

Black Friday 2025 delivered a historic milestone: $11.8 billion in online sales, a 9.1% year-over-year increase. These record-breaking Black Friday sales demonstrate the continued strength of digital commerce.

What’s driving the surge:

- Earlier discount cycles

- Better mobile checkout flows

- Increased spending in electronics, apparel, beauty, and fitness equipment and wearables

- Heavy influencer promotion and affiliate-powered traffic

High confidence (95%) signals that digital Black Friday is far from peaking.

7. Mobile Shopping Dominance

More than 55% of Black Friday purchases happened on mobile devices—solidifying mobile as the primary shopping channel in the U.S.

Key factors:

- Seamless app UX

- One-tap payment options

- Social commerce integration

- Younger shoppers spending predominantly via mobile

The shift toward mobile-first retail is accelerating rapidly.

8. BNPL Usage Growth

Buy Now Pay Later adoption grew 9% year-over-year during Black Friday, providing financial flexibility amid consumer budget constraints.

BNPL continues to rise because it:

- Reduces upfront cost barriers

- Drives higher AOV (average order value)

- Supports spending even in strained economic climates

- Is now integrated into virtually every major checkout flow

Positive sentiment and strong confidence suggest BNPL will remain a core payment preference into 2026.

9. Shopify Merchant Sales Boom

Shopify merchants saw record-breaking momentum, generating $6.2 billion in Black Friday sales—a 25.1% year-over-year increase.

What’s behind the Shopify surge:

- Global reach and frictionless store setup

- Improved checkout infrastructure

- Integrated payment and fulfillment tools

- Growth of microbrands and DTC sellers

Shopify’s performance signals a robust long-tail expansion of small-to-mid-size online retailers.

10. Cyber Week Total Sales Surge

Cyber Week spending hit $44 billion, up 7.7% from last year. Consumers are extending shopping into a full-week cycle rather than concentrating on a single day.

Behavioral insights:

- Deal-hunting distributed across multiple days

- Flexible employer schedules and remote work increasing mid-week shopping

- Improved forecasting from retailers leading to steadier promotions

Cyber Week’s growth confirms a shift toward extended seasonal purchasing.

What These Trends Mean for Brands and Retailers

Across all 10 trends, several macro patterns emerge:

- AI is becoming the backbone of digital commerce—from discovery to checkout.

- Consumers are increasingly global, mobile, and omnichannel.

- Visual and interactive tools like AR are reshaping product evaluation.

- Economic tension is shifting payments toward flexible models (BNPL, subscriptions).

- Holiday shopping is no longer a 1-day event—it’s an ecosystem.

Retailers that prioritize personalization, frictionless UX, and flexible purchasing infrastructure will outperform in 2026 and beyond.